The Fed Interest Rate, a pivotal economic indicator, often makes headlines, but its significance goes beyond financial news. It wields considerable influence over the economy, affecting everything from mortgage rates to job growth. In this comprehensive article, we’ll delve deep into the world of the Fed Interest Rate, exploring its history, the factors shaping it, and the consequences it carries. Whether you’re an investor, a homeowner, or just curious about economic mechanics, understanding the Fed Interest Rate is essential.

Fed Interest Rate: Unraveling the Basics

What is the Fed Interest Rate?

The Fed Interest Rate, formally known as the federal funds rate, represents the interest rate at which depository institutions (such as banks) lend reserve balances to other depository institutions overnight. In essence, it’s the rate at which banks borrow money from one another.

Why Does the Fed Control Interest Rates?

The Federal Reserve, often referred to simply as “the Fed,” plays a critical role in managing the economy. One of its key tools is the manipulation of interest rates. The Fed adjusts rates to achieve economic goals, primarily targeting stable prices and full employment.

The Power of Monetary Policy

Understanding the Fed Interest Rate requires knowledge of monetary policy. The Fed uses this policy to influence economic conditions. When it lowers interest rates, borrowing becomes cheaper, encouraging spending and investment. Conversely, when it raises rates, it aims to curb inflation and slow down an overheating economy.

A Historical Perspective

The Birth of the Federal Reserve

The Fed, established in 1913, was a response to the frequent financial crises that plagued the United States. It was created to provide stability to the financial system.

The Early Years

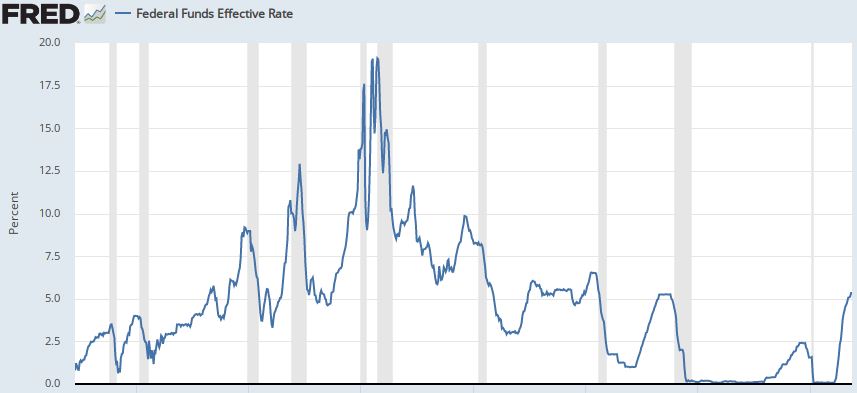

In the early 20th century, the Fed Interest Rate remained relatively stable. However, the Great Depression in the 1930s forced the Fed to reevaluate its policies, leading to more active rate management.

The Post War Era

After World War II, the Fed adopted a more systematic approach to monetary policy. This era saw the birth of the modern Fed Interest Rate, with regular adjustments to steer the economy.

Factors Influencing Fed Interest Rate Changes

Economic Growth

One of the primary drivers of rate changes is the state of the economy. When it’s robust, the Fed might raise rates to prevent inflation. Conversely, during economic downturns, it may lower rates to stimulate growth.

Inflation

Inflation, the increase in the general price level, is a significant concern. The Fed raises rates to combat inflation when it exceeds its target rate.

Employment

The Fed also considers the employment rate. Lowering rates can help boost job growth, while raising them can be a tool for slowing down an overheating job market.

International Factors

Global economic conditions, including exchange rates and geopolitical events, can influence the Fed’s decisions.

Political Landscape

The political environment can indirectly affect the Fed’s decisions. For instance, during an election year, the Fed might be cautious about making significant rate adjustments.

The Ripple Effect: Impact on Various Sectors

Changes in the Fed Interest Rate have far-reaching consequences. Let’s explore how it affects different segments of society.

Homeowners and Mortgage Rates

For homeowners, the Fed Interest Rate is of particular importance because it influences mortgage rates. When the rate drops, it can lead to lower monthly mortgage payments, making homeownership more accessible.

Savers and Investors

Conversely, savers and investors may not welcome rate cuts, as they often result in lower returns on savings accounts and bonds. However, lower rates can encourage investors to seek higher returns in the stock market.

Businesses and Borrowing

Businesses also feel the impact of the Fed’s decisions. Lower rates can reduce the cost of borrowing for expansion or investments in new equipment.

The Stock Market

Stock markets tend to react swiftly to changes in the Fed Interest Rate. Typically, lower rates are seen as favorable for stocks, as they can boost corporate profits and encourage investors to move capital into equities.

International Trade

Changes in interest rates can impact exchange rates, which, in turn, affect international trade. A stronger U.S. dollar, driven by higher rates, can make American exports more expensive.

The Fed Interest Rate in Recent Years

To gain a better understanding of the Fed Interest Rate’s impact, let’s take a closer look at recent developments.

Post 2008 Financial Crisis

In the aftermath of the 2008 financial crisis, the Fed lowered interest rates to near-zero levels. This move aimed to stabilize the economy and encourage borrowing and spending.

The Taper Tantrum

In 2013, the mere suggestion of the Fed scaling back its bond-buying program, known as quantitative easing, led to a market panic, dubbed the “taper tantrum.” This underscores the sensitivity of financial markets to Fed actions.

The Pandemic Response

The COVID-19 pandemic prompted unprecedented measures, including multiple rate cuts, to counteract economic downturns and stimulate recovery.

Conclusion

The Fed Interest Rate is undeniably a linchpin in the world of economics. Its influence ripples through the lives of individuals, the strategies of businesses, and the stability of nations. As we’ve explored its history, factors, and impact, it’s evident that keeping an eye on the Fed’s decisions is essential for anyone navigating the complex landscape of finance and economics.